Writer of summary – Le Thi Quynh Anh (No:04)Na

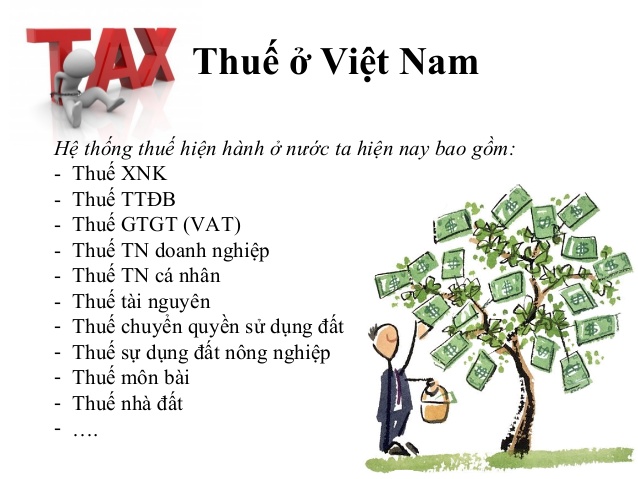

That article is about the current taxes in Viet Nam: Taxes are a major source of revenue for the state budget. In Vietnam, there are more than 10 taxes with different tax rates. In fact, there are areas in which businesses have suffered from 12 to 15 taxes and fees, resulting in reduced contributions to the state budget. At the same time, Vietnam is one of the countries with income from people on the total income of the society is very high compared to other countries with the same level of income and development level. Together with other economic policies, tax policies can become a tool to support domestic businesses as well as attract international investment. In other words, taxes can become a “competitive tool” at the government level. The government will have preferential tax policies for sectors, occupations, sectors and objects that are encouraged to develop through different taxes or rates.

Therefore, when we set up a business, we need not only to thoroughly research economic policies and laws but also to thoroughly research tax policies to take advantage of and exploit the incentives.

For example, when we want to implement an agricultural project, we will consider high-tech agriculture for export. In this area, we will enjoy preferential value added tax, corporate income tax, natural resource tax, etc. We also enjoy preferential interest rates from banks for this field.

In addition, each country will have different tax policies. In the integration period, many companies earn high profits through their subsidiaries established in the “tax haven” and investment back into Vietnam, profit earned them transferred to the company located in the country level. Low taxes to “spleen” much higher taxes if left in Vietnam.

Finally, the law sometimes has a loophole and tax law is no exception. If the company understands the tax law, it will increase profits by saving the maximum amount of remittances into the state budget.

Reference source: https://www.google.com.vn/search?q=c%C3%A1c+lo%E1%BA%A1i+thu%E1%BA%BF+%E1%BB%9F+Vi%E1%BB%87t+nam&rlz=1C1EJFA_enVN782VN782&source=lnms&tbm=isch&sa=X&ved=0ahUKEwiqj6bp1pLZAhVIL48KHYL0AOwQ_AUIDCgD&biw=1366&bih=662#imgrc=Pkmb84VypH2FtM:

Kết thúc cuộc trò chuyện

|

Thank for the summary. could you add a title ? the sources of the article and of the picture ? could we be innovante in law ? in taxes ?