TRAN THI THU TRANG – ID.19

TRAN THI THU TRANG – ID.19

VU THI KHANH LINH – NO.12

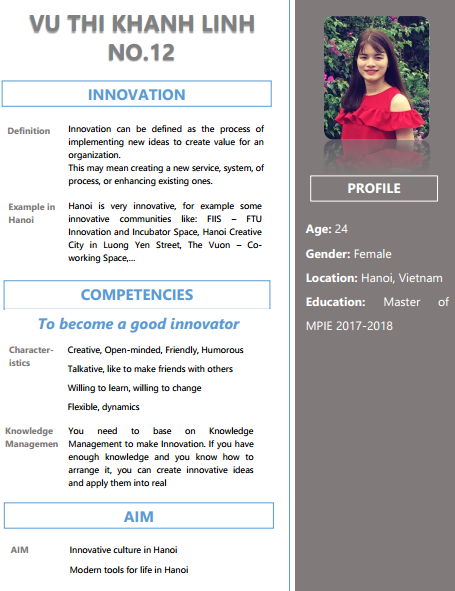

Nguyen Hoang Long – ID 13

Hanoi is known as an ancient city however, nowadays Hanoi has been developing many innovative activities and organizations. From economic development view, Hanoi is considered as a young city, which results to change to working way and enviroment. Following that the rise of entrepreneurship is based on the creative working method. This is one of the most innovative ideas for Hanoi.

For instance, Hanoi has more and more accelerators, incubators, co-working space, innovation lab and creative hubs. Lets take “TOONG” as an example. It is not only a co-working space in Hanoi but also aims to become a house of invention where business leaders and entrepreneurs can work, collaborate and socilize.

Another example is Creative Lab Project in Inovation Labin Hanoi city. It was opened on June 25, 2017. In this space, customers can use all the mordern equiment and machinery, share their ideas, develop new products, as well as build a relationship with potential partners.

That is the way that Hanoi is creating the innovative value for the development not only for human but also for society.

Team member:

Phu Duc Anh 01

Ngo Minh Anh 02

Vu Thi Khanh Linh 12

Nguyen Manh Tung 17

Tran Thi Thu Trang 19

In our opinion, Hanoi is definitely an innovative city and has great potential to become more and more innovative in the future. We can easily find the innovation in many fields. In terms of innovation companies, we have around over 200 start-ups in different sectors such as: Foody (Food & Beverage), Topica (Education), MoMo (Individual Finance), etc. We have incubators like FIIS, HubIT, 5Desire. We have creative co-working space as Hanoi Hub, Vuon. Moreover, in education, we also have innovative universities and projects like: USTH, MPIE, etc. However, Hanoi still has many things that can be changed to be more innovative. We can have better innovative environment with the good guidance and control from government. All the start-ups and entrepreneurs can have more support in finance with investment from banks and venture capitalist inside Hanoi, not just from foreign investment. We can consider Ha Noi as an innovative city but it is just at the beginning of the innovation process. We still need to invest more both in finance and human resource to push up all the innovative projects and ideas in the future. Therefore, all the stakeholders need to be involved and together to make Hanoi become more innovative.

Group 3:

Team member:

Nguyen Hoang Nam: No 14

Hoang Thi Thai Ngan: No 15

Le Thi Quynh Anh: No: 04

Nguyen Hong Hanh: No 07

Nguyen Mai Huong: No 09

Nguyen Thu Ha: No 06

Nguyen Hoang Long: No 13

https://www.britishcouncil.vn/sites/default/files/social-enterprise-in-vietnam-concept-context-policies.pdf

Name: Hoang Thi Thai Ngan 015

SUMMARY

Social Enterprises have been formed from social initiatives, based on the need to address specific social issues of the community and led by entrepreneurial spirit of the founders. This unique dynamism and dynamic character leads to a public perception of the dynamic development of social enterprises. Up to now, nearly 200 organizations in Vietnam are considered to have attached the full features of social enterprises; the pioneering social organization was established in 1990, however, the concept of social enterprises is still very new in Vietnam.

Social enterprises are often recognized as “hybrid” models between two types of non-governmental organizations, non-profit organizations and enterprises. In fact, the Social Enterprise model can be applied to different types of organizations with different legal status, such as NGOs, limited companies, share companies, cooperatives, foundations, unions.

In the period before “Doi Moi”, Vietnam already had a number of models that could be regarded as social enterprises, which were cooperatives providing jobs for people with disabilities. After 1986, the renewal and open-door policy of the development within and outside the country.

Social enterprises in Vietnam face many difficulties due to limited public awareness official recognition from the state, lack of clear legal regulations, limited human resources, accessibility capital, management skills, community cohesion, as well as a system of intermediaries to provide support services and networking …

Social enterprises can help the Government achieve social goals. The promulgation of the law establish legal framework, formally recognize and issue specific policies to encourage and supporting social enterprises, as well as institutionalize the implementation of such policies is extremely necessary.

Personal analysis

There are four development trends in this article and I found NGOs trend is really interest. It associate with business arms to give more social value.

REACH is a local, VNese, non-government organization which was established in 2008, specializing in vocational training and employment for VN’s most disadvantage youth. They use an innovative, highly pragmatic and effective training model. In 2016, they have trained over 1000 students, with nearly 90% of their graduates obtaining and keeping a stable job within 6 months.

Image source: https://get.google.com/albumarchive/106727892139902648740/album/AF1QipPllb9up_Y3jgC1l1Niahj2Ae4mjWScciNaV6nj/AF1QipO64OespGgPadIQeMC0fyNFRYLcf2Rmj93QmoTU?source=pwa#6355623479793482706

Image source: https://get.google.com/albumarchive/106727892139902648740/album/AF1QipPllb9up_Y3jgC1l1Niahj2Ae4mjWScciNaV6nj/AF1QipO64OespGgPadIQeMC0fyNFRYLcf2Rmj93QmoTU?source=pwa#6355623479793482706

Writer: Nguyen Hong Hanh – Number: 07

Source: https://www.fundamentalsofaccounting.org/wp-content/uploads/2017/11/ifrs_course.jpg

In Vietnam, Finance Statement regulations are follow Rules-based Accounting. Some countries followed this regulations such as Indonesia, Thailand, Phillipines… But the International Financial Reporting Standards (“IRFS”) follow Principles-based Accounting. Do these regulations have any conflicts in business results? This article will bring you an aspect about this question.

“IRFS” is applied from 1/1/2005 and over 100 countries have follow this regulations. Principles-based Accounting is used as a conceptual basis for accountants. A simple key of objectives are set out to ensure good reporting. The most basic benefit of this is bringing a clear guide to the accountants to specific case because of its broad guidelines and practical in a variety of circumstances. The problem with principles-based accounting is that lack of guidelines sometimes can produce unreliable and inconsistent information that makes it is difficult to compare one organization to others.

Rules-based Accounting is basically a list of detailed rules that must be followed when preparing financial statements. When there are strict rules that need to be followed, the possibility of lawsuits is diminished. Having a set of rules can increase accuracy and reduce the ambiguity that brings to management. The complexity of rules, however, can cause unnecessary complexity in the preparation of financial statements. Countries that follow this regulations will focus on how to write finance statements, rules… When the rules change, the students are worried about they have to learn all over again. Therefore, there is a worry about good students will not be attracted about the curriculum.

The finance standards are now changing rapidly and many countries are applied increasingly, which requires teachers to change the teaching method into principles, suitable with the present business results. The teaching of Principles-based Accounting will increase students’ judging about jobs, how to deal with problems in many cases, understand that there are some answers for one finance question, not only one. This will support students to find solutions by theirself, not by learning by heart.

In Vietnam, from 2001 to 2005, The Ministry of Finance has released 26 Accounting Standards, which are built on the world standards. In this trend, some companies with the foreign investment or big companies has applied IFRS such as VpBank, PVI Joint Stock Company have shown very clear and precise information. Many meetings about applying IFRS has been hold, such as “IFRS – Trend and Roadmap for adoption in Vietnam” in December 2016. From 2018-2020, 10-20 companies will be chosen to follow these regulations, and in the future, more and more companies will follow this. In Hanoi, one of the biggest training courses about IFRS for learners are hold by VCCI and Deloitte Vietnam. They often has courses for companies, bring a fresh view about IFRS and how to apply it in the jobs.

To change completely regulations in Vietnam is still under considering. Companies should encourage and make opportunities for staffs to learn and to change, It will bring a different way in manage business.

Source:

https://www.investopedia.com/ask/answers/06/rulesandpriciplesbasedaccounting.asp

http://vaa.net.vn/Tin-tuc/Tin-chi-tiet/newsid/3951/GIANG-IFRS-TRONG-DAO-TAO-KE-TOAN

Writer: Nguyen Hong Hanh – Number: 07

Vietnam is now a developing country and fastly intergrated with other countries. The opportunities for international companies to join the market is very potential. But to make sure Doing Business in Vietnam is on the right way, there are many regulations that companies should know to be competitive. Some important aspects I will mention in this summary is Accounting and Auditing, Human Resources and Employment Law, Banking and Capital Markets, which cover many business activities of every company.

The accounting framework is now fully complete and suitable for Vietnam companies and international companies. There are currently 26 Vietnamese Accounting Standards (“VAS”) and the accounting framework is mainly rules-based accounting rather than a principles-based one. Rules-based accounting is a list of detailed rules that must be followed in financial statement. With a set of rules, the accuracy will increase and the ambiguity will diminished. The accounting period is generally 12 months in durations and audited annual financial statements must be completed within 90 days of the end of the financial year. One thing that the foreign-invested entities must remember that they will be audited by an independent auditing company operating in Vietnam. “VAS” and International Financial Reporting Standards (“IFRS”) have some key differences, such as a number of key accounting standards (regarding financial instruments and impairment of assets) have not been issued yet in Vietnam, so foreign companies may need to examine the rules carefully.

In Employment Law, foreigners working in Vietnam must have a work permit issued by the labour management authority, the maximum duration of a work permit is 24 months. With the population of over 92 million, around 40% of the population is under 25 years of age, Vietnam is expected as a potential market with young generation. Approximately 22% of the population is consider to be trained or skilled, so they have the ability to apply knowledge to work and they are as good as the foreign labour force.

According to Vietnam authorities, a minimum legal capital levels for foreign banks’ branches, finance companies are US $15 million and VND 500 billion respectively. Foreign investors can own more than 30% of the total shares in a local bank. The activities is controlled by the Prime Minister on a case by case basis. Every year, credit instituons and foreign banks’ branches must review and assess the adequacy, validity, effectiveness and efficiency of internal controls. These report shall be submitted to the key stakeholders, the State Bank of Vietnam within 30 days from the end of the fiscal year. With these strict controlling, Vietnam expects companies are followed equally in a fast developing environment.

Vietnam has brought many opportunities not only for local companies but also to companies from all over the world. If business entrepreneurs understand rules carefully, they can make a difference with high quality products.