Writer: Minh Anh Ngo / ID: 002

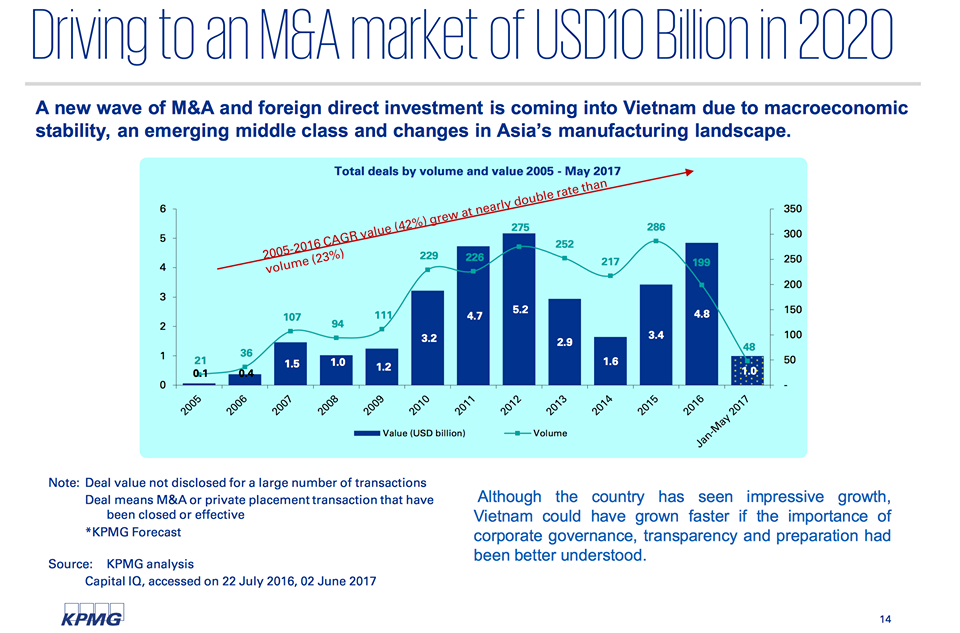

According to a report from KPMG in 2016, we could see there was a dramatically change in volume of M&A activity in Vietnam from 2010. KPMG ranked Vietnam as one of the most dynamic market ASEAN area, although inbound investment was far away to outbound. Value of outbound was USD3 million, comparing to USD5,052million of inbound. Investment coming from foreign leaded to the takeover of oversea firm.

In M&A Vietnam market, volume was driven most from both private and public transaction. While private deal was from retail, pharmaceutical and real estate sectors, state – owned enterprise preferred public transaction, for example: Vietnam Airline, Vissan.

Source: KPMG

One of the most remarkable M&A was Petrolimex, a state – owned firm, JX Nippon Oil & Energy bought 8% share, which was never approved before. Following this deal, Vinamilk, Saigon Beer were allowed to sell out stakes. They would be target to foreign investors in the next year.

One side, the M&A made a boost on business activities of the firm by exchanging resources, capital, and technology. Another, it may be a threat to main owner because the M&A plans were much depend on oversea investors, who had a lot of experience in the field, but Vietnamese was not. So some M&A followed “western”strategy which may cause damage to former owner.

Source:

https://home.kpmg.com/content/dam/kpmg/vn/pdf/publication/2017/deals-in-vietnam-webinar.pdf

http://www.iflr.com/Article/3673293/2017-Mergers-and-Acquisitions-Report-Vietnam.html

Thanks for the analysis and article : what kind of innovative strategy could create former owner to create value ? and what kind of values ?